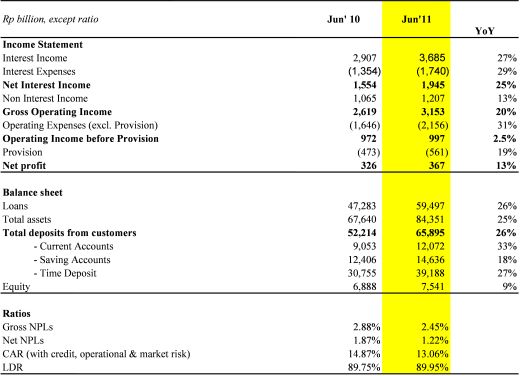

PT Bank Internasional Indonesia Tbk (“BII” or the “Bank”) continued to book strong loan growth in the first six months 2011. The Bank recorded a 26% consolidated loan growth from Rp47.3 trillion in the first semester 2010 to Rp59.5 trillion in the first semester 2011. The Loan growth was evenly spread out across all business segments as Consumer loans grew by 28%, followed by Corporate and SME & Commercial which increased by 26% and 24% respectively compared to the first semester 2010. Corporate loans accounted for 24% of total loans, while SME & Commercial and Consumer Loans contributed 36% and 39% respectively. The Bank’s total asset as of 30 June 2011 increased 25% to Rp84.4 trillion from Rp67.6 trillion as of 30 June 2010.

Rahardja Alimhamzah, BII’s Acting President Director, said “I am pleased that we continue to show sustainable growth across all business segments though there is still much to accomplish in our quest for greater growth and higher market share. Our growth record and ability to tailor products to customer needs as well as continued investments in the Bank’s infrastructure, and continuous improvement in all aspects of operations have placed us on the right track in capturing higher market share and achieving our aspiration to be the best financial provider in the markets we serve”.

Total deposits from customers increased by 26% to Rp65.9 trillion as of 30 June 2011, up from Rp52.2 trillion recorded in 30 June 2010. Current Accounts grew 33% to Rp12 trillion as of 30 June 2011 from Rp9.1 trillion as of 30 June 2010, while Savings Accounts increased 18% to Rp14.6 trillion from Rp12.4 trillion and Time Deposits went up 27% to Rp39.2 trillion from Rp30.8 trillion. The loan to deposit ratio (LDR) remained stable at 90% compared with the previous corresponding year.

“Our branch and electronic channel expansion, innovative loyalty and acquisition programs, new product launchings combined with proven excellent service quality will certainly support and contribute to the growth of the Bank’s customer deposits. The recently launched mobile banking and new internet banking platform that will be launched soon will enable the Bank to further attract new customers and expand our customer base.”

The Bank’s growth across the business segments was accompanied by improved asset quality. The Bank’s gross non performing loans (gross NPL) level reduced to 2.45% as of June 2011 from 2.88% in June 2010 and net NPL improved to 1.22% from 1.87%. The improvement in asset quality was achieved through the Bank’s continuous effort in strengthening its risk management and credit processing while implementing quicker loan restructuring programs and closer monitoring of existing borrowers.

Loan loss provision expense in June 2011 increased 19% from Rp473 billion in June 2010 to Rp561 billion in June 2011 due to the higher provision expense for WOM’s portfolio primarily related to its venture into second hand motorcycle financing. Given this situation, WOM has now curtailed the financing for used motorcycle while redefining used motorcycle business model and distribution channel to improve its asset quality. In addition, WOM has also undergone strengthening its core management team to provide better oversight in this area.

The Bank’s net interest income (NII) improved by 25% YoY from Rp1,554 billion in June 2010 to Rp1,945 billion in June 2011. The tight competition in the banking industry has put pressure on the Net Interest Margin (NIM) across the banking industry. In June 2011 the Bank was able to hold its NIM at 5.43% compared to 5.63% in the corresponding period in 2010.

Other operating revenues (fee based income) as of 30 June 2011 increased by 13% to Rp1,207 billion compared with Rp1,065 billion in the same period last year. The Bank’s total fee based income was mainly generated by increases in fees from corporate deals, treasury transactions, credit card usage, trade finance, remittances, and other services. The total fee based income contributed 38% to the Bank’s total income.

Total overhead costs increased 31% from Rp1,646 billion to Rp2,156 billion reflecting the Bank’s aggressive network expansion and investments in human capital as well as IT infrastructure throughout the first semester 2011. As of June 2011, the Bank has 344 offices (including Syariah and overseas branches) and more than 1,000 ATMS.

The Bank’s net profit increased 13% to Rp 367 billion in the first semester 2011 compared to Rp326 billion in the first semester previous year on the back of the business growth across the business segments and the Bank’s overall operational improvements.

The Capital Adequacy Ratio (CAR) was at 13.1% as of June 2011, well above Bank Indonesia’s minimum requirement of 8%. The Bank’s recent sub debt issuance in April 2011 has strengthened the Bank’s tier 2 capital by Rp1.5 trillion. The Bank’s total tier 1 and tier 2 capital as of 30 June 2011 reached Rp9.2 trillion.

Maybank Chairman and President Commissioner of BII, Tan Sri Dato’ Megat Zaharuddin bin Megat Mohd Nor added, “I am pleased that BII’s efforts to expand our coverage and deepen our customer focus has led to strong growth. Additionally, we have seen encouraging synergies with the Maybank Group in various business areas which now have started to bear fruits. The Bank’s sincere attention to the communities it serves, by providing customers with products and services which are of value and fair, reflects the Group’s mission in Humanizing financial services Across Asia”.

Selected Performance Highlights

Consolidated

Note for Editor:

BII is one of the largest banks in Indonesia with an international network that comprises 344 branches including five Syariah branches and 3 overseas branches, 1,017 ATMs and 15 CDMs (Cash Deposit Machines) BII across Indonesia, and also connected with more than 20,000 ATMs under ATM PRIMA, ATM BERSAMA, ALTO, CIRRUS, and Malaysia’s MEPS network, and to more than 2,800 Maybank ATMs in Malaysia and Singapore as well as a banking presence in Mauritius, Mumbai and the Cayman Islands. As of 30 Juni 2011 total customer deposit base of Rp65.9 trillion and Rp84.4 trillion in assets, BII provides full range of financial services through its branch and ATM network, phone banking and internet banking channels. BII is listed on the Indonesia Stock Exchange (BNII) and is active in SME/Commercial, Consumer and Corporate banking.

For further information, please contact:

Esti Nugraheni, Division Head of Corporate Communication

Ph: +6221 2300-888

InvestorRelations@bankbii.com