- Group emphasises 4 ESG commitments as part of M25 Sustainability agenda

Maybank today presented its long-term sustainability commitments designed to propel the Group’s growth and strengthen its position towards becoming a regional ESG leader by 2025.

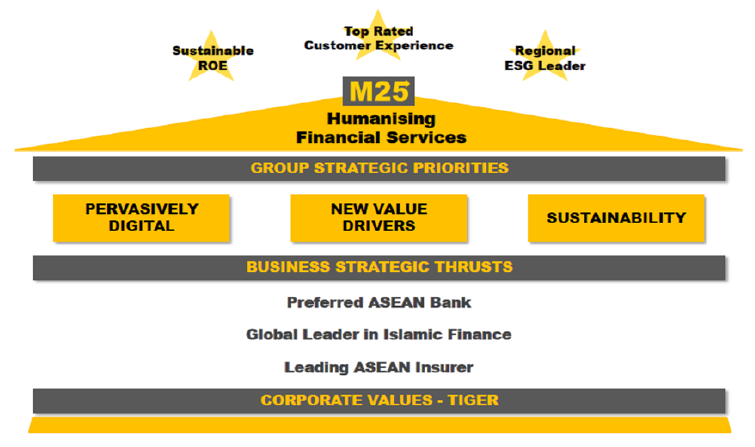

The commitments are part of the Sustainability strategic priority under the Group’s M25 Plan, and focus on achieving sustainable growth by enabling responsible transition to a low carbon economy, while at the same time, empowering communities and leading by example with good governance practices.

Speaking at a media briefing on Maybank’s Sustainability Day, Group President & CEO of Maybank, Datuk Abdul Farid Alias said that the commitments give a better understanding as to how the Group will prioritise material issues and re-define its sustainability agenda, including setting of goals, targets and KPIs.

“In line with this undertaking, we have elevated our Group Sustainability Council to an EXCO Sustainability Committee, and established a Board Sustainability Committee to reinforce our commitments in driving our sustainability agenda into the future,” he said.

Datuk Farid added that as part of the efforts to ensure strict adherence to its Sustainability strategic priority, the Group will monitor its progress throughout the M25 journey with tools and measurement parameters that have been, or are being developed, to guide and track all major commitments.

“These will be undertaken concurrently as we continue to drive innovation to provide the best customer experience, aligned with our purpose of humanising financial services.”

Under Maybank’s strategic priority for Sustainability, four key sustainability commitments are to:

i. Mobilise RM50 billion in Sustainable Finance by 2025,

ii. Improve the lives of 1 Million households across ASEAN by 2025

iii. Achieve a Carbon Neutral position for Scope 1 and 2 emissions by 2030 and Net Zero Carbon Equivalent position by 2050, and

iv. Achieve 1 Million hours per annum on Sustainability & Delivering 1 Thousand Significant Sustainable Development Goals (SDG)-Related Outcomes by 2025.

These commitments will be translated down to the various Business and Support Sectors as well as subsidiaries as specific KPIs for them.

Meanwhile, the Chief Sustainability Officer of Maybank, Shahril Azuar Jimin, said that over 15 workstreams and their sub-teams had since last year formulated some 180 Detailed Implementation Plans (DIPs) under the four commitments. These DIPs are being executed across the Group throughout the M25 period to create the systemic change in embedding sustainability across the organisation. The workstreams will also ensure that continuous engagement is undertaken with all relevant stakeholders to ensure alignment with Maybank’s aspirations.

Delving into details on the progress of the four commitments thus far, Datuk Farid said these would support the other two strategic priorities under the M25 Plan, namely being Pervasively Digital and creating New Value Drivers for the Group.

Mobilising RM50 billion in Sustainable finance by 2025

This commitment covers direct lending or investment, and services related to arranging, syndicating, fundraising or underwriting as well as advisory, all of which will integrate ESG criteria. To this end, the Group is currently developing a Sustainable Product Framework to complement existing efforts in the area of sustainable finance. Amongst others, this Framework will outline the methodology and procedures to classify financial products and services offered by Maybank into various categories - green, sustainable and/or transition solutions. Targeted to be implemented within the year, this will account towards the recognition of the Group’s sustainable financial achievement.

At the same time, the Group will be scaling up existing Green, Social and Sustainability (GSS) Bonds/Sukuk, project financing for green projects, ESG thematic funds, GSS loans, Sustainability linked trade products, Sustainable supply chain financing platform, Sustainability linked derivatives, Structured products and providing new green solutions via the Group’s Community Financial Services and Insurance sectors.

Improve the lives of 1 Million households across ASEAN by 2025

To drive this commitment, Maybank aims to contribute towards the betterment of the people and society in the ASEAN region. This includes initiatives to help with employment, raising income, as well as reducing inequality and poverty, thereby creating a more equitable society. Maybank’s efforts under this initiative will be aligned to the 169 targets under the 17 United Nations (UN) Sustainable Development Goals (SDGs).

The commitment will be driven through three key strategies namely equipping communities with lifelong financial skills & knowledge, addressing current & situational needs , and building financial resilience. It will be measured by metrics such as the number of households benefiting from

Maybank’s community programmes, number of SMEs benefiting from Education & Financing Assistance Programmes, number of customer loans approved (covering auto, 2-wheeler and mortgage) as well as sale of micro products and the launch of micro insurance products in countries such as Cambodia and Indonesia.

Achieve Carbon Neutral position for Scope 1 and 2 emissions by 2030 and Net Zero Carbon Equivalent position by 2050

The Carbon Neutral 2030 commitment refers to the Group’s own emissions while the Net Zero 2050 commitment refers to achieving an overall balance between all direct and indirect C02e, covering our operations and the business activities we finance.

As part of these commitments, Maybank will manage our internal environmental impact in areas such as emissions, waste and water consumption. These include implementing energy efficiency programmes to reduce internal power consumption, seek renewable energy sources, improve

infrastructure efficiency reduce staff travel and increase green building footage, as well as managing waste and water consumption and boosting recycling efforts . The Group will also support suppliers to meet ESG principles and standards as well as step up efforts to include more SME suppliers and minority groups in procurement engagements. At the same time, all efforts will be made to strategically drive Maybank’s business portfolio towards reducing emissions.

Achieve 1 Million hours per annum on Sustainability & Delivering 1 Thousand Significant SDGRelated Outcomes by 2025

Recognising that employees play a key role in living and promoting sustainability, Maybank aims to further shape a sustainability culture among its employees and embed sustainability actions and thinking across its business, operations and community-based programmes.

This will include strengthening of business ethics policies & practice as well as transparency & trust among stakeholders; enhancing persity, equity & inclusion programmes and policies, and scaling up Maybank’s employee volunteerism programme.

In line with this, a tracking mechanism is being finalised to capture both the manpower hours spent internally on sustainability initiatives and the SDG outcomes, while revisions or enhancements have been made in relation to the Group’s Privacy Notes, Data Governance Framework and Privacy Policy.

Maybank Group Chief Risk Officer, Gilbert Kohnke said that Maybank’s sustainability commitments are guided by a comprehensive risk management approach with ESG considerations continuously being integrated into business decision making. These include identifying material high ESG risk sectors, implementing industry-specific ESG criteria, and establishing Risk Assessment Criteria for all sectors.

“Our deliverables in the area of ESG follows through from our sustainability journey taken over the years, including our commitments of ‘No Deforestation, No New Peat and No Exploitation’ (NDPE), not providing financing to black-listed activities deemed not in line with the Group’s core values and no financing of new coal activities while transitioning together with existing borrowers to achieve sustainable renewable energy mix over the medium- to long-term.”

He added that Maybank Group’s key priority will be to continue ensuring that all key business decisions will be based on ESG principles, with customers and the community being at the foremost of everything undertaken.

M25 Plan