Maybank Islamic Launches New Diversified Investment Product Offering Higher & Stable Returns

KUALA LUMPUR, 9 DECEMBER 2020: Maybank Islamic Berhad today launched the Multi-Asset Investment Account-i (MAIA), a closed-ended investment account that aims to maximise investment returns by investing equally in a diversified portfolio of the Bank’s stable financing assets and Islamic marketable securities.

Maybank Islamic’s profitable and stable financing assets comprise mortgages, hire purchase and unit trust financing while the appointed External Investment Manager, Maybank Islamic Asset Management (MIAM) will invest the remaining 50 per cent in Islamic marketable securities, such as equities and Real Estate Investment Trusts (REITs).

MAIA seeks to achieve potentially higher returns of 4.25 per cent per annum for a three year placement making it an attractive investment given the current low interest rate environment. The investment product is the first of its kind to be offered by a bank in Malaysia and aims to reach RM250 million in investments.

First investor: Dato’ Mohamed Rafique holding the product e-brochure with Maybank Premier Wealth Relationship Manager, Queeny Yip. On the right is Maybank Islamic Head of Investment Account, Idham Sabki Baharum.

Maybank Islamic CEO Dato’ Mohamed Rafique said: “We trust that MAIA will be able to meet the needs of investors who are seeking for Shariah investment options which aims to preserve capital whilst generating stable and relatively higher returns.

The launch of MAIA is another milestone for us as we are the first Islamic bank to establish an investment product that offer investors the opportunity to invest in not just our stable financing assets but also in Islamic marketable securities.”

Dato’ Mohamed Rafique added that with the current economic uncertainty arising from the Covid-19 pandemic, Maybank Islamic aims to assist its clients to navigate and grow their investments, especially those who are looking to potentially achieve income and capital growth by investing primarily in the financing portfolio of the largest Islamic bank in Malaysia as well as a portfolio of Shariah compliant securities.

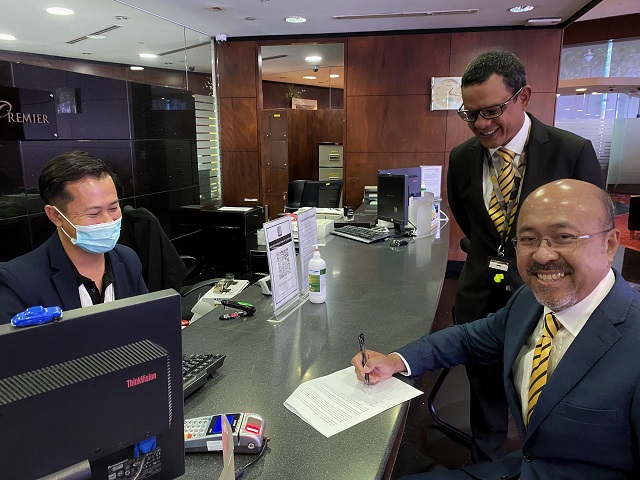

Dato’ Mohamed Rafique signing the document for his investment in MAIA, assisted by Maybank Premier Wealth bank officer, Mohd Hairul with Maybank Islamic Head of Investment Account (right) Idham Sabki Baharum looking on.

Under the Islamic Financial Services Act (IFSA) 2013, Islamic financial institutions are allowed to become investment intermediaries, and Maybank Islamic was the first to embrace this with the launch of its Investment Account (IA) product back in 2015.

Under IA, MAIA marks another investment product innovation for the Bank.

MAIA provides opportunities for investors with a medium to long term investment horizon and is open to individuals and institutional investors with a minimum investment of RM10,000.

###

About Maybank Islamic Berhad

Maybank Islamic is ASEAN’s leading Islamic bank and is the largest Islamic commercial bank in Malaysia with a market share of 30.8% of Islamic financing as well as deposit and investment account at 28.9% as at September 2020. For the third quarter ended 30 September 2020, Maybank Islamic’s total assets stood at RM259.2 billion, a growth of 8% year-on-year.

For more information, kindly contact:

Strategic Communications

Maybank Islamic Berhad

Level 4, Tower A, Dataran Maybank,

1, Jalan Maarof, 59000, Bangsar, Kuala Lumpur

Roziana Hamsawi 03 2297 2211 | +6012 324 6502 | roziana.h@maybank.com

Fadhli Asri 03-2297 2479 | +6017 930 0395 | mnfadhli.aa@maybank.co