1. What is LIBOR?

London Interbank Offered Rate (LIBOR) serves as the benchmark interest rate used in various financial contracts such as loans, bonds, derivatives and mortgages, with estimated exposures totalling USD 400 trillion1 globally on a gross notional basis.

LIBOR is calculated for five major currencies: US Dollar (USD), Euro (EUR), Pound Sterling (GBP), Japanese Yen (JPY), and Swiss Franc (CHF) and 7 tenors – Overnight, 1 week, 1 month, 2 months, 3 months, 6 months, and 12 months. It is based on submissions from designated panel banks and these submissions are intended to reflect the interest rate at which banks could borrow money on unsecured terms in wholesale markets.

2. Why does LIBOR need to be replaced?

Following the 2008 financial crisis, the liquidity for unsecured interbank funding markets referencing LIBOR has reduced significantly, driven by the introduction of short-term wholesale funding rules, money market reforms, and Basel III liquidity rules. As a result, LIBOR is increasingly reliant on expert judgement by panel banks rather than actual underlying transactions. This issue has been of high concern to regulators given the importance of LIBOR in financial contracts globally.

In 2017, the Financial Conduct Authority (FCA), the UK body that regulates LIBOR, declared2 that it will no longer compel panel banks to make LIBOR quote submissions after 2021 and that the market participants should expect LIBOR to be subsequently discontinued, or no longer deemed representative.

3. When will LIBOR be discontinued?

On 5 March 2021, the Financial Conduct Authority (FCA) announced3 that all LIBOR settings for all currencies will either cease or no longer be representative immediately after the following dates:

|

Reference LIBOR

|

Tenor

|

Dates

|

|

GBP, EUR, JPY, CHF

|

All

|

31 December 2021

|

|

USD

|

1W, 2M

|

31 December 2021

|

|

USD

|

O/N, 1M, 3M, 6M, 12M

|

30 June 2023

|

4. When will Maybank stop offering LIBOR products?

Maybank will stop issuing products referencing to the following LIBOR rates on dates as follows:

|

Reference LIBOR

|

Tenor

|

Dates

|

|

GBP, EUR, JPY, CHF

|

All

|

30 June 2021

|

|

USD

|

1W, 2M

|

30 June 2021

|

|

USD

|

O/N, 1M, 3M, 6M and 12M

|

31 December 2021

|

5. What does this mean for other IBORs?

Benchmark interest rate reforms are underway in various jurisdictions to improve the integrity and reliability of interest rate benchmarks. IBORs for other currencies such as Swap Offer Rate (SOR) and Thai Baht Interest Rate Fixing (THBFIX) that use USD LIBOR as calculation input will be discontinued after 30 June 2023.

BNM has appointed the Financial Markets Committee (FMC) to oversee the development of a transaction-based Alternative Reference Rate (ARR) for Malaysia and deliberate on the strategic direction for the KLIBOR and KLIRR. It is proposed for the Malaysian ARR4 to be based on overnight transactions in the interbank market and that the ARR will run in parallel to the existing KLIBOR.

7. What will replace LIBOR?

Risk Free Rates (RFR) are alternative reference rates that have been developed for use instead of LIBOR.

RFR Working Groups across a range of countries have identified alternative RFRs for the relevant currencies as follows:

|

Currency

|

USD

|

GBP

|

JPY

|

CHF

|

EUR

|

|

RFR

|

Secured Overnight Financing Rate (SOFR)

|

Sterling Overnight Index Average (SONIA)

|

Tokyo Overnight Average Rate (TONA)

|

Swiss Average Rate Overnight (SARON)

|

Euro Short-Term Rate (€STR)

|

|

Administrator

|

Federal Reserve Bank of New York (FRBNY)

|

Bank of England (BoE)

|

Bank of Japan (BoJ)

|

SIX Swiss Exchange

|

European Central Bank (ECB)

|

|

Secured/ unsecured

|

Secured

|

Unsecured

|

Unsecured

|

Secured

|

Unsecured

|

|

Description

|

SOFR is overnight and transaction-based encompassing multiple repo market segments

|

SONIA is overnight and is calculated based on daily sterling money market activity

|

TONA reflects the uncollaterised, overnight call rate market encompassing multiple repo market segments

|

SARON is an overnight rate that reflects interest paid on interbank overnight repo transactions

|

€STR reflects overnight unsecured fixed rate deposits of euro area banks

|

8. Differences between RFRs and LIBOR

|

Benchmark

|

LIBOR

|

RFR

|

|

Calculation Methodology

|

Forward looking estimates based on panel bank submissions

|

Backward-looking calculated mean based on historical transactions

|

|

Term structure

|

7 tenors: O/N, 1W, 1M, 2M, 3M, 6M, 12M (i.e. LIBOR has a term structure)

|

Overnight only

|

|

Secured/Unsecured

|

Unsecured

|

Secured: SOFR and SARON

Unsecured: STR, SONIA, TONIA

|

|

Term and credit premium

|

Incorporate a term and credit premium

|

RFRs do not include the panel bank credit risk element nor a liquidity premium related to the length of the interest period as they are overnight rates.

|

|

Volumes

|

Based on submission by contributor banks

|

Based on actual transactions in a highly liquid underlying market

|

RFRs are considered to be more robust and less prone to manipulation, given the volume of observable data.

As RFRs do not include the panel bank credit risk element nor a liquidity premium related to the length of the interest period as they are overnight rates, term and credit spread adjustments5 may need to be applied to the relevant RFR to be used as fallbacks to LIBOR.

The BNM Shariah Advisory Council (SAC) has ruled that the adoption of risk-free rate (RFR) as an alternative benchmark rate to LIBOR, or as a fallback benchmark replacement rate after the permanent cessation of LIBOR, is permissible.6

9. What does this mean for Maybank and what actions are Maybank taking to assist customers?

The transition to RFRs may affect our retail, commercial and institutional customers who use our financial services and rely on LIBOR as a reference rate. Maybank has put in place resources to review the impact of the LIBOR transition to existing services and products and will engage our affected clients, to provide relevant support during the transition. In addition, Maybank is actively monitoring the latest industry developments and recommendations to align itself with market best practices

10. Do clients need to do anything now?

Clients are encouraged to develop an understanding on LIBOR transition and to evaluate their LIBOR-related exposures. This will include assessing the risks and impacts that might arise on their contracts and businesses.

Clients should also consider seeking independent professional advice on the potential implications of LIBOR transition on areas such as legal, tax, accounting, financial and operations.

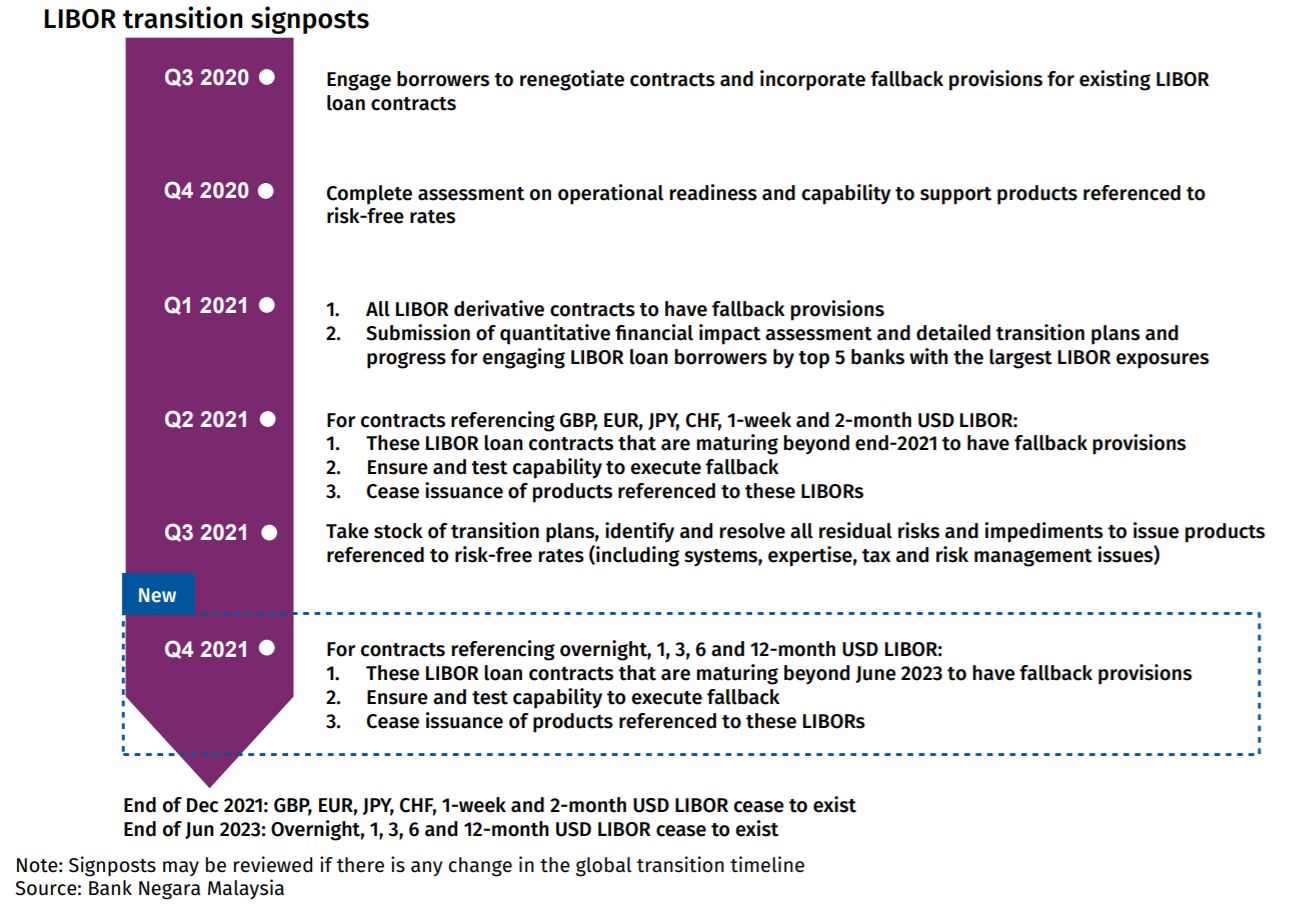

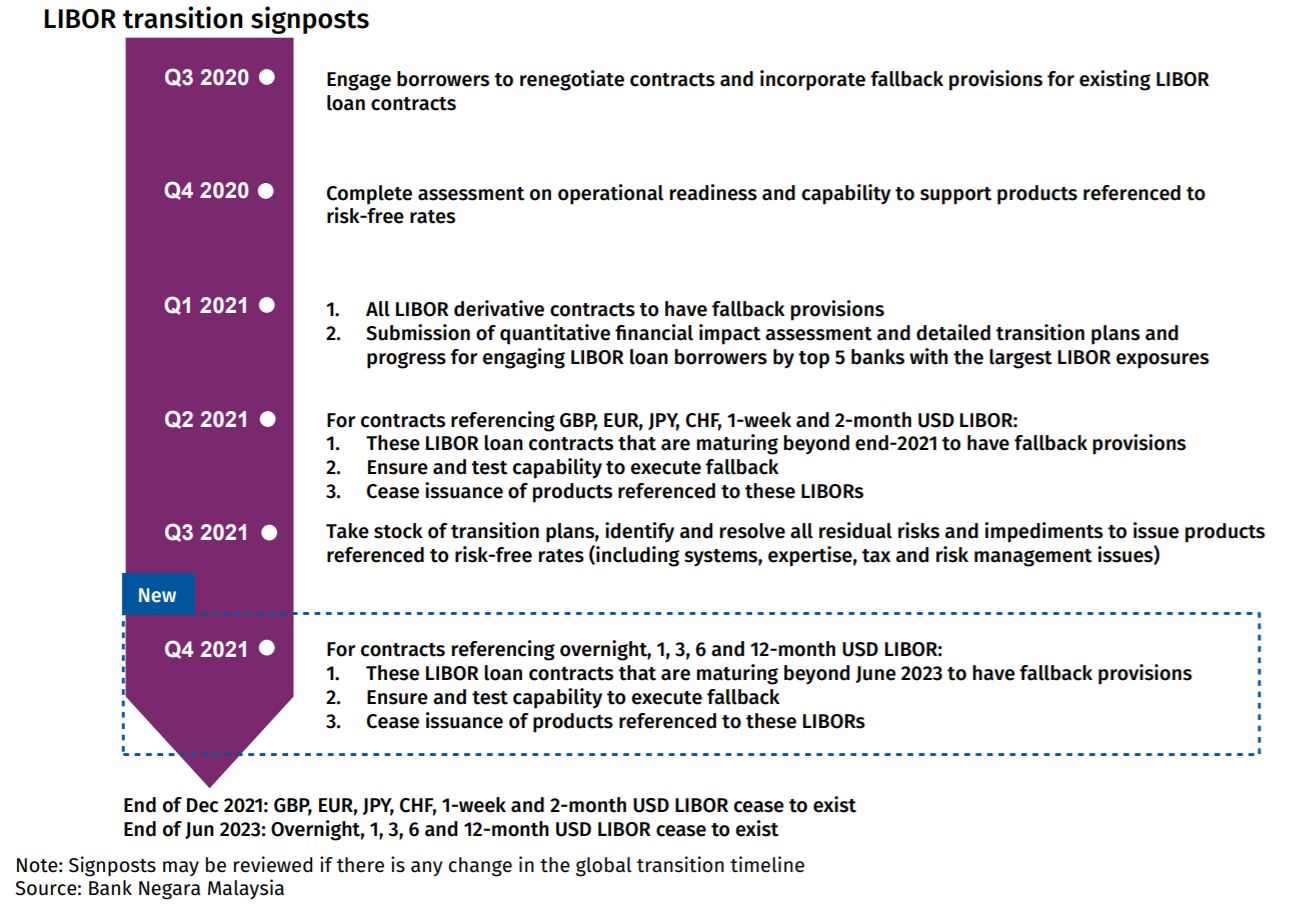

11. BNM LIBOR Transition Signposts

For the Malaysian banking industry, BNM has established key signposts7 to ensure that banks adequately

prepare for and manage a smooth transition away from LIBOR :

The Maybank Group is committed to aligning to these timelines and ensuring our clients are informed.

12. BNM LIBOR e-brochure for Maybank Customers

Bank Negara Malaysia’s LIBOR transition signposts requires the cessation of all new issuances of LIBOR referencing contracts by 31 December 2021. On 22 October 2021, BNM published an e-brochure that emphasises the urgency for bank customers to be prepared for the transition from LIBOR to RFRs.

For further reference, you may download it here.

References

- https://www.bankofengland.co.uk/-/media/boe/files/financial-stability-report/2020/may-2020.pdf

- https://www.fca.org.uk/news/speeches/the-future-of-libor

- https://www.fca.org.uk/publication/documents/future-cessation-loss-representativeness-libor-benchmarks.pdf

- https://www.bnm.gov.my/documents/20124/938039/dp_Alternative+Reference+Rate_may2021.pdf/cd9770bc-a487-9ba9-157c-beb66d1bb301?t=1621401282014

- https://www.isda.org/2019/11/15/isda-publishes-results-of-consultation-on-final-parameters-for-benchmark-fallback-adjustments/

https://www.bankofengland.co.uk/-/media/boe/files/markets/benchmarks/summary-of-responses-on-consultation-credit-adjustment.pdf

https://www.newyorkfed.org/medialibrary/Microsites/arrc/files/2020/ARRC_Recommendation_Spread_Adjustments_Cash_Products_Press_Release.pdf

- https://www.bnm.gov.my/-/sac-bnm-210th-meeting

- https://www.bnm.gov.my/documents/20124/3026574/fsr2020h2_en_ch2_fi.pdf

Additional Reference

- ISDA 2020 IBOR Fallbacks Protocol (Protocol)

https://www.isda.org/2020/05/11/benchmark-reform-and-transition-from-libor/?_zs=jI4hO1&_zl=jeI06

Maybank Corporate

Maybank Corporate Maybank Islamic

Maybank Islamic  Investment Banking

Investment Banking Business Banking

Business Banking SME Banking

SME Banking Asset Management

Asset Management Private Wealth

Private Wealth Premier Wealth

Premier Wealth ASPIRE

ASPIRE

Customer Service

Customer Service